Prepaid Travel Cards Offer Agencies a Lucrative Revenue Stream

Prepaid cards of one sort or another are nothing new. In fact, they've been around for decades, and have long had something of a controversial reputation among consumers. It's only in recent years that travellers have started to benefit from their presence.

On the face of it, prepaid travel cards solve a number of common travel problems. For that reason, it's no surprise that travel agencies have got on board and started to work travel cards into their traditional offerings. Not only are they generating ongoing revenue with an added extra at the point of sale, they are providing travellers with an easy, cost-effective solution to the problem of spending money abroad. Everyone's a winner, right?

We spoke with Rob Darby, who's head of travel partnerships at Tuxedo Money Solutions. In case you didn't know, Tuxedo is one of the UK’s leading prepaid service providers, delivering payment technology for businesses around the world.

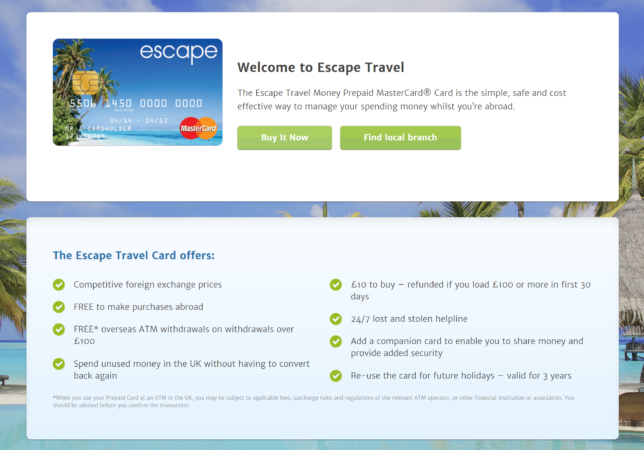

The specific offering that will come up a lot in this article is Tuxedo’s 'Escape' card, which Tuxedo offers to travel agents to resell to customers or preload and offer for sales and marketing promotions. Tuxedo claims to offer agents the chance to earn "attractive commission payments for the life of the card", too.

Why do prepaid travel cards exist?

Prepaid travel cards are the result of necessity. On the one hand, travellers have slowly grown frustrated about having to carry huge amounts of foreign currency with them on trips abroad. Nobody wants to hold wads of cash when they are 1.) in an unfamiliar place and 2.) supposed to be having a relaxing holiday.

The traditional method of crossing borders armed with a stuffed envelope of freshly exchanged currency is outdated and risky. Not only could you lose all of your spending money, it also makes tourists a target for pickpockets and thieves.

The convenience of topping up a card before you leave the country is ideal. No longer do travellers have to carry huge amounts of cash. Instead, instant access to their spending money is available through the card. These cards are often linked to online accounts or applications, meaning that they can be topped up on the go, too.

On top of that, many prepaid travel cards help tourists avoid expensive withdrawals in foreign countries. ATM machines can do real damage to travellers' bank accounts, and free, easy access to their cash abroad is something that tourists have been wanting for years.

There's also the saving aspect. Typically families will put money aside for a holiday in a separate account, but travel cards allow you to stash away spending money directly onto the card that you will be spending with - a small touch, but convenient nonetheless.

Additionally, offerings such as the Escape card outlined above provide customers with ongoing support just as an ordinary bank would. A 24-hour lost and stolen helpline is a strong selling point for travellers who want to feel looked after.

With all these benefits laid out, it's easy to see why travel agencies would want to offer prepaid cards such as this to clients. And that's before the notion of commission is involved. As Tuxedo says, its Escape Card allows operators to "provide a better customer experience whilst increasing revenue." - What's not to love about that?

Prepaid Travel Cards: The Numbers Game

Speaking with Rob Darby, head of travel partnerships at Tuxedo, we asked for his take on the appeal for prepaid travel cards. Why is it that travel agencies are looking to Tuxedo and other prepaid card providers for these solutions?

"UK residents spent £39 billion during trips overseas in 2015, the highest amount recorded by the UPS and a 9.8 percent increase from 2014", he said. On top of that, "the global prepaid card market is anticipated to reach ,653 billion by 2022, with Europe dominating in terms of revenue, accounting for more than 49.1 percent share of the global market. This presents agents with an opportunity to capitalise on this lucrative market, whilst providing their customers with a safe, simple and cost-effective way to manage their spending money abroad."

It's perhaps a reflection on the current state of the industry that travel agents are looking for additional products to boost revenues. "At Tuxedo," says Darby, "we’ve witnessed a marked increase in demand for our Escape Travel Money Prepaid Mastercard, as travel agents look for long-term revenue rewards on easy-sell products."

It's clear that prepaid travel cards allow travellers to plan ahead and keep a check on their spending abroad. The moment that personal credit or debit cards, often with fixed fees on withdrawals and transactions, come out to play, travellers enter dangerous financial territory.

The timing of conversion from one currency into another is also important. "Travel cards that are loaded in the holder's currency with conversion made at the time of use ensures holidaymakers are getting the most up-to-date exchange rate," said Darby. "Furthermore, with this type of card, they will not be charged for unloading money not spent nor will they face further exchange rate charges for converting into another currency should they travel abroad to another country later in the year."

Financial safety is also as important as physical safety. "In addition to the cost savings, and perhaps more importantly, is the benefit of being safe, with no connection to customers’ bank accounts. With a Travel Money card, travellers are offered a convenient and safe alternative to carrying cash or their bank cards abroad. They also offer much greater flexibility while ensuring they get the most bang for their buck, each and every time."

Prepaid card users can also avoid a range of fees that many travellers are unaware of. "Dynamic Currency Conversion (DCC) is also a little-known charge on foreign transactions that is still catching holidaymakers out but luckily there is a rule of thumb that is easy to go by. When a consumer pays a bill abroad using a credit, debit or prepaid card, they may be given the option to pay in the local currency or in their own currency. If they choose their own currency they could be hit with hidden charges because the retailer or ATM will apply their own conversion rate – and this can be vastly different from that of their card issuer."

By opting to pay in the local currency, the holidaymaker’s card issuer will convert the money at a rate that many will publish in advance. For those customers who have already loaded a prepaid card in the local currency opting to pay in that currency saves them from a second conversion fee. By always opting to pay in local currency, holidaymakers could save themselves money at every transaction.

Travel cards changing the modern traveller's experience

Darby suggests that the prepaid travel card industry is "continually evolving in line with consumer demand and technology improvements." For example, he says that "a prepaid Travel Card allows travellers to budget by providing a separate ‘travel wallet’, which can be used as a savings account between booking and travelling. The ability for cards to be managed easily, on the go, online and via SMS is a key benefit for the modern traveller, who often demands instantaneous results. Furthermore, providing one ‘pot of money’ means customers can have multiple cards, allowing them to access and share funds without needing to be present 24/7."

How travel agencies can benefit from relationships with prepaid card suppliers

"Tuxedo's Escape Travel Money Prepaid MasterCard has been designed to deliver significant income potential for partners," said Darby. "Escape enables distributing partners to earn attractive commission payments for the three-year life of the card. This new offering boasts numerous benefits for both partners and cardholders, setting it apart from competitors.

And there are several options for agencies that want to distribute cards on behalf of Tuxedo, from an “off the shelf” solution that can be up and running in as little as 14 days to co-branded or fully white label options. "With these options," says Darby, "the card and customer communications become a branded travel essential that will remain front of wallet for holidays now and in the future."

Tuxedo’s solution offers a "generous" commission rate to distributing partners, paid over the life of the card for all loads, not just the initial load. These cards can also be used for promotions, and can be given away preloaded and used (and earned on) for years to come.

The Future of Prepaid Cards: Do Travellers Want Something Different?

It's only natural to assume that the way we pay for things is going to change dramatically in the coming years. Travellers also tend to be a forward-looking bunch, and are bound to be among the early adopters for new payment technologies. With that in mind, how much longer can travel agents rely on prepaid cards for a welcome boost to revenues?

If more disruptive technologies start to emerge, will the role of travel agents in currency matters become further diminished?

At one end of this scale we have smarter, more flexible money management platforms like Revolut. At the other, we have the emerging yet slightly futuristic technologies that use a combination of biometrics and smart devices to handle our finances and payments.

Let's take a closer look at Revolut- Could this be the new kid on the block for the prepaid travel card industry?

There are a few things that travellers find frustrating when it comes to money management:

1. Exchanging currency: Getting a decent rate is almost impossible. Whether it's withdrawing cash from your prepaid card abroad, at your local supermarket or inside the airport, it always seems as though someone is making a profit from the exchange. As a result, the traveller is not getting the best possible deal.

How new money platforms like Revolut solve this problem: Revolut offers instant currency exchange at inter-bank rates. Travellers can make an exchange through the app, whether they are currency trading or preparing for a trip.

2. Accessing money when abroad: Prepaid travel cards are great for safety, security and budgeting, but they can leave travellers feeling separated from their cash. For globetrotters who work on the road, this is far from ideal.

How Revolut solves the problem: The Revolut app allows travellers to transfer money to and from external accounts, send money to friends in other countries in whatever currency you like, pay bills, track expenses and exchange currencies - free.

3. It's not free to spend money abroad: Travellers don't like to feel short-changed. In a modern, connected world, should banks really be charging for international withdrawals and transactions abroad?

How Revolut solves the problem: With a Revolut card, spending money is free. Simple as that.

4. People can feel separated from the normal help banks offer when travelling

You get the idea by now: An in-app chat gives Revolut users instant access to help when they need it. The travel industry is ideal for instant messaging - more on that here.

It seems clear that disruptive startups like Revolut are going to change the way travellers handle their money in the years to come. Prepaid cards have already taken giant leaps forward and made handling travel money far easier than it used to be.

Now there looks to be few new kids on the block. Whether travel agencies will be able to become as intertwined with these global money apps remains to be seen.

We spoke with Revolut's Grace Stuart. She pointed out that many prepaid cards "tend to add a markup to the exchange rate or charge fees to spend your money around the globe."

"Ultimately," she said, "Revolut is more than a prepaid travel card. We’re building a21st-centuryy banking alternative designed for your global lifestyle. Customers can transfer 23 currencies to any bank around the world; see a categorised breakdown of their daily spending; split bills instantly with their phone contacts; and block or unblock their card at any time."

But the bad news for travel agencies making commission from prepaid card sales: Revolut has no such affiliate program in place. "We do not have an affiliate program," confirmed Stuart. "We have gained over half a million customers primarily through word-of-mouth referrals. The ease of sending and requesting money from friends or family via the Revolut app has also allowed our user base to grow organically.

"It seems likely that consumers will increasingly turn to prepaid cards to spend, save and manage their money. FinTech's, like Revolut, are much faster than banks when it comes to delivering the functionality that consumers are looking for."

For example, Revolut users can now apply for a personal loan from the app in 3 minutes and receive the money instantly in their account. The same process with major UK banks could take a week and cost you double."