Amadeus Report: Four Potential Futures of the Travel Industry

The world is a complex place and we are living in particularly complex and tumultuous times. We've looked on plenty of occasions at different trends from the spheres of technology, sociology and politics. We do this in an effort to predict and outline how these trends are going to impact the travel industry. Then we think of ways startups can adapt to meet those challenges.

However, we've never looked at the big picture and tried to pull all of the different strands together. Fortunately, that's been attempted for us by an Amadeus & A.T. Kearney report, titled ‘What if? Imagining the future of the travel industry’.

The report identifies several risks and trends that the travel industry should heed over the next decade.

It even goes as far as to offer four possible world scenarios that could come to pass, outlining how the travel industry would have to adapt to each. Sounds interesting, right?

So let's get into it.

What are four possible futures for the travel industry?

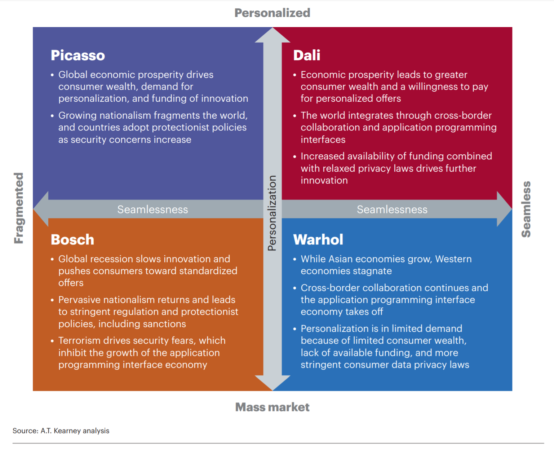

So let's start at the beginning. The report argues that there are four global scenarios that travel companies need to start preparing for today. If they want to maximise future growth, that is. These are named after famous artists:

- Picasso

- Dali

- Bosch

- Warhol

As you can see from the graphic above, the report suggests that changes in the travel industry landscape hinge on two separate battles.

The first is the battle between personalised experiences and mass market opportunities. There is no doubt that in the future, advanced technology and artificial intelligence will enable the aggregation of consumer data on a huge scale. Companies will never before have had so much insight into market trends. They should, therefore, become more and more adept at appealing to the masses. But on the flip side, all of this data could be applied on an individual basis, removing the need for the traditional one-size-fits-all approach.

The second conflict is between seamless travel versus increased fragmentation. Freer movement and more open borders will require huge political and social changes. Even on a small scale, governmental cooperation and data sharing between businesses will be needed, from airports and airlines to destination services such as hotels, restaurants and ground transportation.

With a more connected world technologically, it can be done. However, it will have to be done against a rising tide of populist nationalism, security fears and anti-free movement sentiment.

“Technology has never held more promise for the travel industry”, says Alex Luzarraga, VP of Corporate Strategy at Amadeus IT Group. “But the status quo is being turned on its head. There is widespread mistrust and populism."

v"Things we used to take for granted, such as the right to travel across Europe without passports, for example, may be less likely in the future. It is important to evaluate and understand those issues that will continue to confront and disrupt the industry in the coming five to seven years, so we can as an industry be better prepared to deal with those issues, and also stimulate economic growth and success as a result”.

Read more: Brexit, Millennials & Youth Travel

Four possible futures laid out by the Amadeus report

The vast chasm between these possible travel industries of the future reflects how pivotal the current moment in time is. It feels as though we are at a crossroads; faced with huge challenges: climate change, mass migration, rapidly advancing technology, economic inequality, terrorism, populism, isolationism, scepticism over open borders. All of these issues will shape our relationship with travel in the years to come.

Read more: How Will President Trump Affect the Travel Industry

And there's no telling how things are going to end up. Although we can rely on the continued advancement of technology, we have no way of knowing in which ways it will be applied. Will it lead to seamless travel, a more personal approach and reduced security fears? Or will it be deployed to restrict travel and shepherd the mass market toward a common theme?

Here are the four futures, based on the conflict between seamless travel, fragmentation, personalised opportunities and mass market groupthink.

The Picasso scenario

The Picasso scenario is the closest world to the one we are currently living in. Things are fragmented; the world is marked by the rise of populism and by heightened security concerns. Think Trump's America, but on a global scale. This has the effect of making more travel destinations off-limits and limits data sharing. Even so, most parts of the world enjoy economic growth.

With more travel restrictions in place and less global insight available to travel companies, there's less choice for customers and companies will be driven to invest in innovation to reach them through mobile channels. This interaction enables businesses to provide more sophisticated personalized offers.

The Dali scenario

The Dali scenario is arguably the ideal future. It assumes that social attitudes and economic prosperity will create a more favourable environment towards the sharing of data. In turn, privacy laws will be relaxed alongside borders and regulations, which could allow for the ultimate personalisation of travel.

In this model we can expect to see an increased influence of data and technology giants, who have all the insight they need to cater for travellers' needs.

The dream of the Dali scenario is that travel becomes faster, cheaper and safer. People benefit from lighter security controls at borders, while developing technology will offer real-time information about unexpected events such as flight delays.

The Bosch scenario

In the Bosch scenario, increased fragmentation will force costs up for travel industry operators. Complying with legal, tax, labour and data protection laws across different companies and continents will be a struggle.

We are confronting a fragmented world based on protectionism and distrust. In the face of Bosch’s political environment, it's likely that travellers will seek comfort in trusted brands and book directly with well-known travel providers. There's isn't much room for gambling.

More regulations and security will mean that, despite advancing technology, technology giants will not have as much influence as they would in a seamless world. Smaller travel agencies will still be valued.

The Warhol scenario

The Warhol scenario is characterised by seamless and not personalised travel that considers the implications of strong economic growth in Asia and stagnation in the west. As travel prices become more restrictive and a growing middle class in Asia comes to the fore with less spending power, travellers will tend toward low cost, mass-market trips.

Asian travellers' tendency towards group travel will also reduce the market for personalised options, even in a world free of barriers.

Will Tech Giants Have a Big Role to Play in the Travel Industry of the Future?

One interesting result of the Dali scenario is the assumed influence of technology giants like Apple and Google and Facebook. In a seamless world dominated by innovation and integration, they seem like likely candidates to monopolise the travel industry.

Google, in particular, has already stepped into the travel space to an extent with a series of investments in flights, hotels and destination services. So how worried should traditional travel agencies be? Will the current 'gatekeepers' take an even bigger chunk of the pie as their role in travel sales increases? Will they take over transactions and become super travel agencies?

According to the founder of Innovation Strategies Miguel Fernandez Diaz, the answer is no, probably not.

There are two reasons for this. The first is that stepping into selling travel packages will lead to technology giants directly competing with their own customers. After all, travel providers struggle without ranking highly on search engines and popping up on social media networks.

The gatekeepers already make a fortune by charging travel operators for various types of marketing and general exposure. The financial gains to be made by stepping directly into the market may be undercut by the lost advertising revenue from companies put out of business.

Second, moving from being the gatekeeper to actively putting together and selling travel packages adds a layer of complexity and responsibility that can be off-putting. Selling travel packages brings with it liabilities and a duty of care to customers - new burdens that might not be appealing.

In sum, it's unlikely that the incentives outway the drawbacks for the world's technology giants.

But that doesn't mean that they won't grow more influential in the travel industry, even if they aren't moving into direct sales. That's because the way things stand, giants such as Google hold the fate of many travel operators in their hands. If you're not ranking highly in search engines for your chosen market, it's going to be difficult to get off the ground.

In the future, the increased role of artificial intelligence and personal assistants, such as Google Home, Siri and Alexa, will present the real challenge to travel agents. These personal assistants will know ever more about our lives, our taste, our habits, our finances and our calendars. It's easy to imagine a world in which our free time and holidays are planned out by these increasingly influential assistants.

The challenge for travel operators then will be to connect to these platforms as efficiently as possible; to, as Skift says, "look for ways to complement the tools that technology platform giants provide consumers, whether that's providing richer travel content or marrying data sets to provide more personalised service during the booking process."

One interesting consequence of tech giants venturing into the travel industry could be the loss of neutrality from search engines. If Google Home is planning your trip for you and offering suggestions based on your history, the function of the search engine has evolved and will be significantly more intimate and personalised. Sure, that's a good thing, but is it fulfilling the promised function of these engines? Would it be giving you access to all the possible options, or just assuming the right ones?

As we become more open to technology and the integration of information, the power of tech giants and their assistant features will become increasingly dominant. So it's perhaps not the case that travel operators should be fearful of a direct rivalry. The fear should more be about 1.) getting left behind as travellers save time by going through virtual assistants and 2.) not being able to connect efficiently and appeal to these new mediums.

Nobody can predict the future of the travel industry

As we've explored in many of our past articles, the travel industry is very much at the whim of emerging trends in technology, economics, geopolitics and society in general. For that reason, it's impossible to say which of Armadeus' future worlds will come to pass.

However, some things are clear and some challenges are inevitable. The growing influence of technology giants in the travel process is one of the obvious ones. While it may not come to pass that these 'gatekeepers' actually sell their own travel packages, there's little doubt that they stand to become more influential regarding travellers' purchasing decisions.

While no travel operator can predict what the future holds, one thing they can do is prepare for a more technologically advanced world in which customers are better informed and better connected. There may not be an appetite for a complete one stop travel shop that tech giants could create, but providers should seek ways to best complement smart assistants, search engines and other tools to stand the best chance of succeeding in tomorrow's world.